A differentiated partner of choice for mid-market privately held businesses

WE ARE OPERATORS WITH CAPITAL.

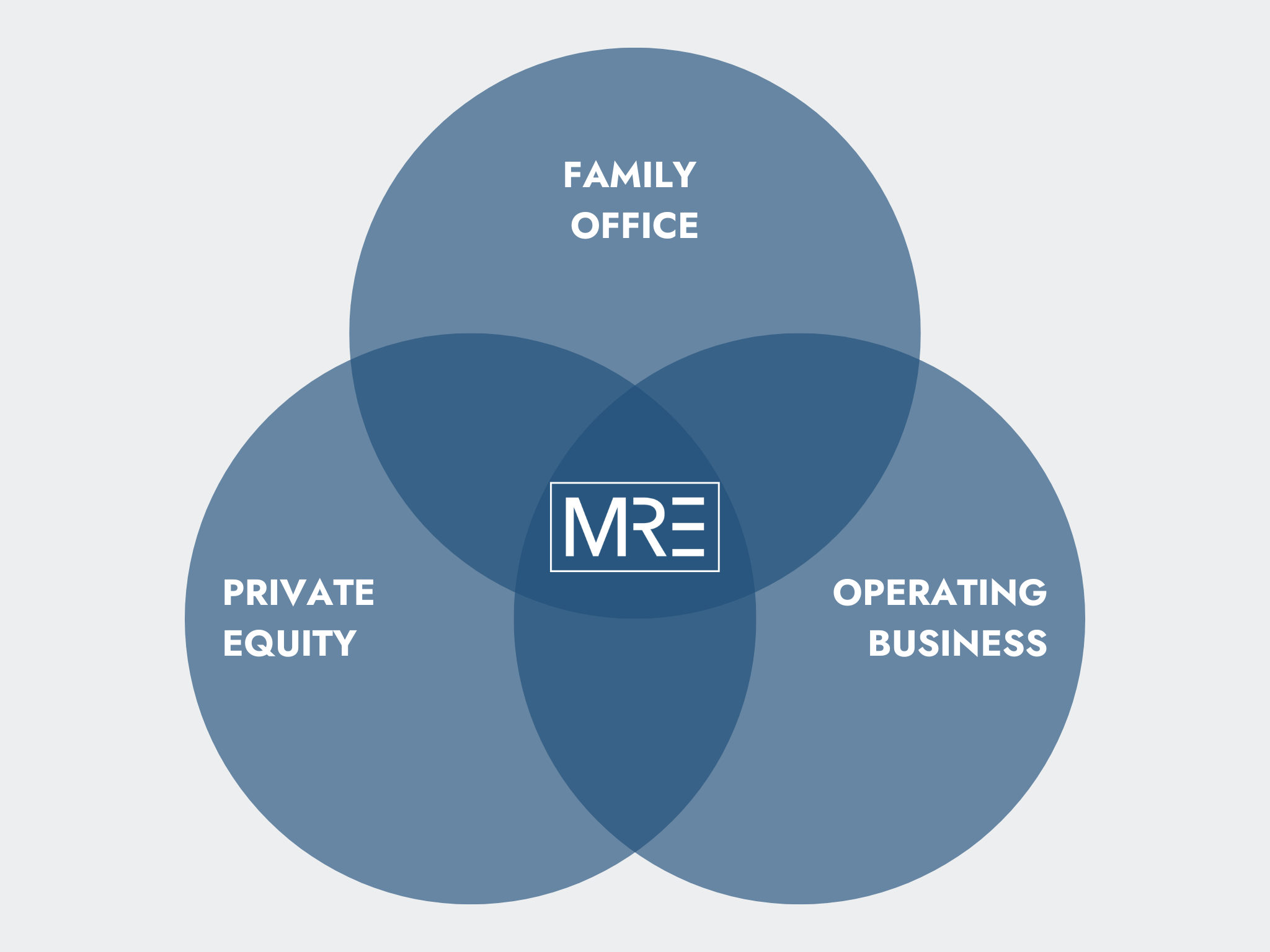

MRE Capital was formed as the family office of David Williams focused on private company investing and development.

David spent more than 30 years building Merkle as CEO, the global leader in tech-enabled marketing services. David acquired Merkle in 1988 with $2.8M in revenue, $800K in EBITDA, and 25 employees. He then grew Merkle to more than $1.2B in revenue, $300M in EBITDA, and 15,000+ employees globally through a combination of service expansion, geography expansion, and M&A. David sold Merkle to Dentsu, the largest publicly traded advertising company in Japan, in 2020, generating a 1,092x MOIC.

Today, MRE Capital is focused on investing in high quality mid-market people-based services businesses with a strong market position, a high quality management team, and a desire to grow over a long period of time.

OUR PASSION

Building and scaling great companies from mid-market to enterprise is our sole focus.

We combine patient capital with operating expertise and focus on materially scaling businesses over longer periods of time. We back ambitious talent and help guide them in developing and growing a business at scale.

Our approach is hands-on, flexible, and aligned — built around shared ambition and real value creation. We're multi-generational investors with a commitment to helping companies grow with intention, resilience, and lasting impact.

WHAT WE BELIEVE SETS US APART

We are not a private equity firm. We are operators with capital.

We combine the long-term thinking and stability of a family office, the financial discipline of private equity, and the focus of building great companies from an operator’s perspective.

We have a flexible mandate to achieve one goal – build great companies. We are active investors with a proven playbook for growth and value creation.

We have a long-term investment horizon with a focus on double-digit multiples of invested capital. We understand that true partnerships are based on a shared vision, trust, and respect.

CORE TENETS THAT DRIVE OUR THINKING

We are passionate about building great companies.

-

Great companies do two things well: focus on being the employer of choice and the market leader in the industry they choose to compete in.

-

Great companies have a strong and compelling vision, mission, and strategy.

-

Great companies are led by strong leaders and supported by a great management team.

-

Great companies consistently grow and are profitable.

-

Great companies have a well-defined management system.

-

Great companies have a purposeful, principle-driven culture that drives desired behaviors.

-

Great companies attract and retain top market talent.

-

Great companies have an unwavering commitment to customers.

-

Great companies continually innovate and evolve.

-

Great companies are well capitalized and financially disciplined.

-

Great companies have the ability to balance the needs of customers, employees, and shareholders.

-

Great companies must have the will to be a great company!

INVESTMENT CRITERIA

We want to focus our efforts on a small core group of companies where we can have deep value-add and trusted relationships with management.

-

INDUSTRY

People-based service industries

Essential, non-discretionary demand

$25B+ market size with GDP+ growth

Fragmented buy & build opportunity

Ripe for technology enablement vs. disruption

-

COMPANY

$25M-$100M in revenue

$5M-$20M in EBITDA

Demonstrated track record of growth & profitability

Recurring/reoccurring revenue

Limited customer concentrations

Clean financials (limited addbacks)

-

TEAM/TRANSACTION

Majority transaction

Family/founder/entrepreneur owned

CEO alignment on path forward

Significant equity rollover